|

|

There is no getting around it. The world’s diamond industry is under stress. And, while Antwerp, the most important global trade center, did not escape 2015 unscathed, it proved to be the best performer, with US$48.3 billion worth of diamonds imported into and exported from the historic Belgian city. Among them were 84 percent of the world’s rough diamonds and 50 percent of all polished diamonds that passed through Antwerp.

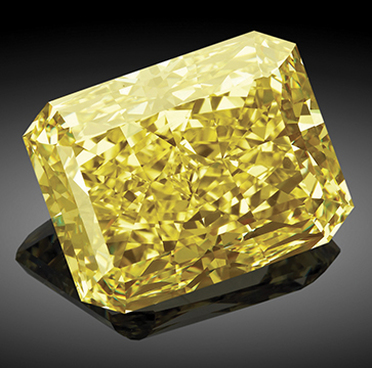

“Fairs are often less about sales, and more about maintenance,” mused Michel Schonfeld, ADTF Organizing Committee spokesperson. “With lots of new buyers coming in and a loyal, ever-growing body of retail jewelers and distributors coming back year after year, we have built strong and lasting business relationships that produce sales throughout the year.” Among the more than 600 loyal buyers attending the ADTF was a certain Mr. Albert M., a Middle Eastern diamond buyer. “We were here for all three days, spent a lot of time in the halls, viewing lots of goods, and holding extended negotiations about the choice of diamonds we had selected. It was not easy, but we did some very serious business here. Antwerp remains the number one source for diamonds. If you do not find what you are looking for here, trust me, you will not find it anywhere.” Well known jewelry designer, Rami Abboud, from Lebanon, who came to source exceptional stones, stated, “I create unusual designs around extraordinary diamonds, which I can find here in Antwerp. The ADTF is a brilliant idea to have so many stones conveniently in one place.” A noted Italian jewelry designer, Maurizio Bassini, was a first time visitor to the ADTF and found the show to be a very “convenient venue to find stones for his pieces.” Germany-based retailer Christophe Zoettl, was delighted with the show and the events surrounding the ADTF, including the breakfast seminars and gala soirée. The Antwerp Diamond Industry As the industry rises and falls on the vagaries of the global economy, the slowdown in the BRIC nations, namely China—the second largest market for polished diamonds after the United States—has had a large impact on the diamond trade. “The global diamond industry took a beating this past year,” stated Ari Epstein, CEO of the Antwerp World Diamond Centre (AWDC), organizer of the ADTF, “with a global decline in sales across the board.” Antwerp saw its total trade value drop from US$58.8 billion in 2014 to US$48.3 billion in 2015. While this represents a decline of nearly 18 percent, competitors such as India and Israel endured much steeper declines.” Epstein added that while the “dramatic downturn in the diamond industry resulted in a slight decline in prices for rough diamonds for the first time in decades, soft prices for polished diamonds made it increasingly difficult for diamond traders to turn a profit. As a result, the average profit margins for wholesalers were between 0.11 percent and 0.37 percent,” similar to results in 2014. Added to the economic downturn were the banking and sovereign debt crises that resulted in changes in availability of funds that could be loaned to businesses, including diamantaires. In this arena, too, the AWDC has been proactive in supporting the industry as Epstein explains. “The international terrain on which the Antwerp diamond industry does business means that we, as the industry’s representative organization, are always searching for new technologies and ways to distinguish ourselves. Last autumn, we organized a Diamond Equity Investment Symposium, together with Morgan Stanley, with the objective being to promote transparency to institutional investors that are considering investing in the diamond industry. This has resulted in a concrete cooperation agreement with two FinTech companies.” He concluded that with the Antwerp “industry’s strong foundations and ability to adopt innovation new technologies and solutions, the city would emerge from this downturn in a position of strength, poised for a profitable year ahead.” Epstein was not alone in his optimism. While some exhibitors at the ADTF indicated that the fair was somewhat slow this year as expected, they were nonetheless happy with new and renewed contacts. Others expressed their satisfaction with sales. From an anecdotal point of view, dealers selling fancy colors attracted the most interest from visitors along with the very unusual Buddha Cut diamond seen at one of the stands. Walking the Halls Strolling the corridors in the historic diamond halls provided the opportunity to see a variety of dazzling diamonds, ranging in size from a few points to upwards of 100 carats, from whites to vivid color fancies, and from traditional cuts to unusual shapes. A few are presented here. Concerning the fancy color category, Nicholas Weinberg, of Level Diamonds, stated, “Only one out of every 10,000 diamonds mined and polished is a natural colored diamond. That makes them the rarest of diamonds in the market. And colored diamonds are consistently outperforming colorless diamonds, and for that matter, even the top three colored gemstones, i.e. sapphire, ruby and emerald.” One of the exhibitors featuring fancy colors was Antwerp Cut, a natural colored diamond manufacturer since 1989, which showcased a wide assortment of colored stones, among them purple, red, green, and blue. Diarough also displayed a number of fancy colors as did Diamprest, which featured mostly pink, brown, and yellow stones, averaging around 0.75 carat. “They have been selling well,” declared Diamprest’s president Antoine Haddad. Many of the exhibitors have been long time ADTF participants, among them Rosy Blue that has exhibited since the beginning of the ADTF. It sells 1 point to 10 carat white stones, as well as a number of large fancy color stones, including a large cushion cut vivid yellow. Another long-time exhibitor, Dalumi featured stones from 10 points to 20 carats plus a range of fancy yellow diamonds. A specialist in large stones, Royal Gem featured 20 to 50 carats in a variety of sizes, with some beautiful pear shapes. “Although the diamond market is struggling,” stated Ben Barmatz, the company's Director of Sales, “our high-end customers are still buying, and prices for the large stones are continuing to rise.” Brachfeld, a fifth-generation company, showcased a range of calibrated pear shapes, 0.25 to 2.5 carats, DEF/VVI+, as well as an exceptional 14-carat vivid yellow. Innovation is a hallmark of the Antwerp diamantaires and probably the most unusual diamond at the ADTF was the Buddha Cut. In the shape of a meditating Buddha, it has 33 crown facets, 21 pavilion facets in addition to the culet, and a polished girdle. Available in several versions, these tiny sculptural diamonds are generally between 0.5 and 5 carats, although they have come in sizes up to 13-carats, according to owner Jacques Korn. Laser-inscribed with an individual serial number on the girdle, these unique diamonds are manufactured and sold by Antwerp-based The Buddha Diamond Company. The most creative booth decoration was that of Beauty Gems, which displayed not only the brand’s logo in diamonds (52.42 carats) but also other lovely images created by Liesbeth Cleen. In addition to its white diamonds, from one point to two carats on average, Beauty Gems also displayed a wide variety of black diamonds, although the whites were the best sellers, according to the company’s director, Nirav Shah. Another booth whose decorations perhaps reflected the current state of the diamond trade was M. & D. Pienica, one of the ADTF’s founders. A poster ad featured a lovely lady with a diamond tear falling from her eye. David Pienica, Director, spoke frankly about the difficult times facing the industry. Drawing on his more than 32 years in the diamond business, Pienica stated that it is vitally important for companies to be healthy in order to weather the headwinds. “The global diamond industry is in the middle of a restructuring and it will probably take another one to two years to stabilize.” He remains optimistic, however, adding that trust and long-term relationships count more than ever. Lab-Grown Diamonds – A Threat? The highly appreciated breakfast seminars included a very well attended and informative presentation on lab-grown diamonds—strictly prohibited at the ADTF—presented by Jean-Mathieu Mangnay, Chief Gemologist of the International Gemological Institute (IGI). “The most pervasive changes and developments we have witnessed in the diamond grading and certification landscape are all focused around the field of man-made diamonds,” stated Mangnay. “Whether you refer to them as ‘synthetic diamonds,’ ‘laboratory-grown diamonds’ or ‘man-made diamonds,’ the indisputable fact is that these stones are chemically, physically and optically identical to their counterparts that are mined naturally.” Mangnay gave an overview of the two primary technologies used to manufacture man-made diamonds: High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). The HPHT stones have been around longer and “were initially relatively easy to detect by the experienced diamantaire, but this is no longer the case,” he said. Mangnay went on to say that CVD diamonds and the latest HPHT diamonds “are much more problematic to identify because, for the first time, experienced diamantaires who are looking at colorless or near-colorless diamonds have almost no way of determining whether they are looking at a natural or lab-grown diamond.” Mangnay concluded that with some 300,000 carats of lab-grown diamonds created per year versus 15 million carats of earth-mined diamonds, there is no real threat to the traditional variety as long as there is transparency in the man-made pipeline. The problem arises, however, with the undisclosed mixing of man-made stones with natural diamonds. “At most of our worldwide labs, we have seen a slow but steady increase in the submissions of small sizes (down to 1 point) of lab-grown. Although the total numbers are not alarming, the pace of growth of these submissions to IGI has been picking up.” He also discussed technologies used to identify lab-grown stones mixed with natural diamonds in jewelry. Mangnay’s presentation was followed by a rather heated discussion among audience members on the undisclosed selling and mixing of lab-grown and natural diamonds. Special Events As usual, the ADTF presented Antwerp Diamond Night, a gala evening sponsored by the AWDC. This year, visitors were treated to a special fashion show featuring models on stilts gracefully walking the runway wearing the creations of the winners and finalists of the biennial HRD Awards. For the 2015 edition of the awards, HRD Antwerp invited designers to draw inspiration from their own culinary heritage while incorporating diamonds in their original creations. Out of a record number of 1531 entries, 29 designers were selected by a jury of industry experts to put their design into production. The first prize went to Tomoko Kodera from Japan for "Rice Husks," a brooch containing 400 handmade rice husks. The other finalists were Shu Liang from China, Evi Bakker from the Netherlands, and Freeman Johnson from China, while Sancha Livia Resende from Brazil was the winner of the public voting award. A second informative breakfast seminar dealt with current consumer trends and the outlook for the diamond sector in 2016, presented by French luxury expert Didier Brodbeck. He indicated that diamonds and diamond jewelry are competing with a much wider “bandwidth” of luxury consumer products than ever before, especially with the millennial generation. The importance of generic marketing for diamonds was also discussed. “The concept of the ADTF has proven a unique opportunity to bring diamond buyers, namely jewelry retailers and manufacturers, from all over the world to the diamond district and make themselves feel at home in our streets and bourses,” concluded Stéphane Fischler, President of the AWDC. Next year’s ADTF will be held the end of January 2017. Entry to the ADTF is by-invitation-only and invitations must be obtained directly from the organizer, either by recommendation from one of the exhibitors or by registering at the website, AntwerpDiamondTradeFair.com. All buyers must produce verifiable documentation that they are qualified members of the gem and jewelry trade. (antwerpdiamondfair.com) |

|