The Evolution of financing in

the diamond industry

Erik Jens, founder of Luxury Fintech, examines a high-value colored gemstone

and diamond necklace at the Dhamani Jewels flagship store in Dubai.

Erik Jens, founder of Luxury Fintech, examines a high-value colored gemstone

and diamond necklace at the Dhamani Jewels flagship store in Dubai.

Over the last decade or so, traditional financing in the diamond industry has slowed, while other types of funding have come onstream. For a better understanding of the overall money situation in the diamond industry, Cynthia Unninayar talks with Erik Jens -- the former global head of of ABN AMRO’s diamond and jewelry client division, and the founder of LuxuryFintech.

Jens kindly shares his views below...

There have been extreme changes in the financing of the diamond industry and trade over the last decade. This has occurred for various reasons, foremost among them was the global macro-economic perspective. Banks, in general, had to de-risk and reduce their balance sheet in the aftermath of the financial crisis due to higher capital requirements by central banks. In other words, for every dollar that banks lent out, they had to keep more reserves on their balance sheet to improve their capital ratios up to higher levels as required by regulators. This impacted not only the diamond sector, but many other sectors which are seen as “increased risk” by regulators, such as some real estate sectors and trade finance in commodities, for example.

Second, it is no secret that the diamond sector was viewed as mysterious and lacking in transparency, which was also illustrated by some high-profile fraud and bankruptcy cases. This created a certain aversion on the part of banks to invest in the sector. It is interesting to see that Episode Two of the Netflix documentary Bad Boy Billionaires featured Modi and Choksi. Their problems did not really have anything to do with the diamond trade as such—theirs was all fraud--but regulators, banks, rating agencies, boards, credit committees, investors, investment committees, etc. see these headlines and wonder why people still finance the sector. They prefer to invest in sectors with a lower risk profile and more asset-based lending where underlying assets are secure. So, each bank pulled out for different reasons.

Healthy Reset

Was this a bad thing for the industry? Not really. Although everyone complained, of course, it significantly deleveraged the diamond sector. Companies were forced to look at their profits rather than their turnover and actually found that, with a lower balance sheet, they were de-risking their business and optimizing bottom-line results. That was a healthy development. Before, they just pumped into their business money that was lent too easily and too cheaply by banks. This meant that companies often did not have their own skin in the game.

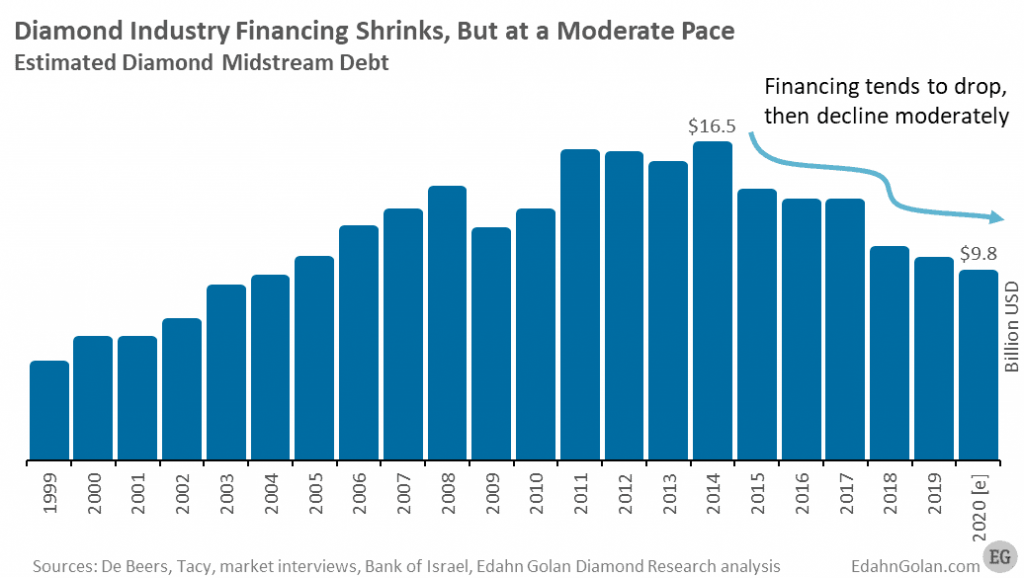

The reduction in financing forced many companies to rethink their strategy, their operations, their manufacturing, costs levels, and structure. In my opinion, this led the way towards a healthier industry as I have always stated that there was too much financing in the sector. If we look at the graph below by Edahn Golan Diamond Research Analytics, we can see the decline over the last decade, from a high of $16.5 billion to $9.8 billion last year. Today, this amount is probably closer to $9 billion as clearly illustrated in the recent report by Bain & Company, Brilliant Under Pressure: The Global Diamond Industry 2020-21.

The reduction in financing is a healthy development, not only for de-risking, but because it attracted some new banks and institutional investors to the diamond sector. I believe they took over about $2 billion from the traditional diamond financing banks. After all, there was no shortage of funding itself, but rather a shortage of finance parties that were still active in the diamond industry.

Second, it is no secret that the diamond sector was viewed as mysterious and lacking in transparency, which was also illustrated by some high-profile fraud and bankruptcy cases. This created a certain aversion on the part of banks to invest in the sector. It is interesting to see that Episode Two of the Netflix documentary Bad Boy Billionaires featured Modi and Choksi. Their problems did not really have anything to do with the diamond trade as such—theirs was all fraud--but regulators, banks, rating agencies, boards, credit committees, investors, investment committees, etc. see these headlines and wonder why people still finance the sector. They prefer to invest in sectors with a lower risk profile and more asset-based lending where underlying assets are secure. So, each bank pulled out for different reasons.

Healthy Reset

Was this a bad thing for the industry? Not really. Although everyone complained, of course, it significantly deleveraged the diamond sector. Companies were forced to look at their profits rather than their turnover and actually found that, with a lower balance sheet, they were de-risking their business and optimizing bottom-line results. That was a healthy development. Before, they just pumped into their business money that was lent too easily and too cheaply by banks. This meant that companies often did not have their own skin in the game.

The reduction in financing forced many companies to rethink their strategy, their operations, their manufacturing, costs levels, and structure. In my opinion, this led the way towards a healthier industry as I have always stated that there was too much financing in the sector. If we look at the graph below by Edahn Golan Diamond Research Analytics, we can see the decline over the last decade, from a high of $16.5 billion to $9.8 billion last year. Today, this amount is probably closer to $9 billion as clearly illustrated in the recent report by Bain & Company, Brilliant Under Pressure: The Global Diamond Industry 2020-21.

The reduction in financing is a healthy development, not only for de-risking, but because it attracted some new banks and institutional investors to the diamond sector. I believe they took over about $2 billion from the traditional diamond financing banks. After all, there was no shortage of funding itself, but rather a shortage of finance parties that were still active in the diamond industry.

Although some banks have pulled back, there is still a significant amount of financing in the industry. The $9 billion or so currently represents the size of lending to the mid-stream sector—the diamond traders, manufacturers, and wholesalers. It does not include loans to producers and large jewelry wholesalers and retailers, which are mostly corporate structures with normal working capital facilities available from banks corporate divisions.

Within the diamond sector, we are now seeing a dichotomy developing. The larger more corporatized global companies still enjoy relatively easy access to funding from banks and institutional investors, while small to mid-sized companies in the diamond sector face more challenges in obtaining funding since bank requirements are constantly stepping up because of the enhanced regulations I referred to earlier. They require bank loans from a few million dollars to around $50 million.

Furthermore, we need to recognize the differences in the diamond sector itself. In some regions, banks and investors are more active than in others. This means that a shortage of financing may occur in some areas where it may not even be possible to open a bank account, or even some accounts may be frozen. When that happens, companies may not be able to pay salaries and/or rent. This all will lead to further consolidation and further corporatization. Is that bad? Not really, as I am convinced that some smaller companies will overcome these challenges and reinvent themselves into a healthy and sustainable business, thus becoming more bankable again. Under pressure, a lot is possible. I see a whole new generation of diamantaires rising up and taking responsibility to innovate in terms of strategy, technology, design, polishing, and all kind of new partnerships. Think of the Young Diamantaires Group with almost 300 active members from 18 different countries—the new generation that has shown creativity in problem solving and creating new opportunities for the diamond and jewelry industry. All of the above has created huge opportunities for new trading hubs, where the platforms are making more asset-based funding available to their clients. It is perhaps time for new initiatives, especially when financing is available, along with new technology, infrastructure, logistics, etc.

It is also important to mention that today banks and institutional investors look not only at their client’s balance sheet, ratios, and strategy, but also at their Corporate Social Responsibility (CSR) agenda. These investors want to know if their clients are taking matters such as environment, social responsibility, and governance seriously enough. Such organizations as the Responsible Jewellery Council (RJC) and the World Jewellery Confederation (CIBJO) are extremely active in those areas and can provide guidance for industry players to fulfill CSR and Environmental, Social and Governance (ESG) goals in line with the UN 17 Sustainable Development Goals (ESGs).

What Effect has the Pandemic had?

I don’t think there has been a significant or structural change in financing of the diamond industry because of the pandemic. Having said that, the decline in trade due to the pandemic reduced the need for diamantaires to seek financing, which in turn meant that banks have less debt outstanding on their books. The banks—as partners in business with the industry—are thus in a better position to help companies recover after the pandemic. And some financial institutions were more lenient in their terms to help clients get through these unprecedented times.

I am confident that the market will recover after this reset. People did not go out much during the lockdown. They did not spent a lot of money. When markets open up, I am sure they will want to treat themselves to art and jewelry. This is happening already in Asia. Self-purchasers and the younger generation will lead this trend, in my opinion. Bridal will be strong, too, since many weddings were postponed due to the virus.

Yet, one caveat though. I am convinced that people want to buy jewelry and art that has a story, a purpose, not just something from the shelf or the counter. Storytelling, provenance, authenticity, natural, and socially responsible—will be even more important.

LuxuryFintech - Technology in Service of the Luxury Jewelry and Art Sector

When I left ABN AMRO in 2018, I took a break and reflected on my banking career and I decided to bundle all my experiences in banking and corporate sustainability into a value proposition for companies in the luxury sector with a focus on art and jewelry. I added my new expertise in financial technology—fintech—particularly related to blockchain. Yes, blockchain is a buzz word, but it represents a very important new technology, as important as the internet itself.

I thus created LuxuryFintech, whose services are related to (re)structuring, funding, introductions, improvement programs, consolidations, etc. This new adventure is very exciting, and, despite the Covid lockdown and curfews, we are well-positioned to provide services for 21st century businesses. We are supporting many initiatives in various states. One of them is FineArtBourse - YourDiamonds, which is a trading/auction platform with full transparency of pricing in the diamond world. Another is Gemcloud, a unique B2B buying/selling platform for the colored gemstone industry. Others involve advising companies in the art sector as well as introductions of investors to gemstone companies seeking funding such as Greenland Ruby. Last but not least, we are involved in developing production facilities for lab-grown diamonds in Canada, B.C., in its very early stage.

Within the diamond sector, we are now seeing a dichotomy developing. The larger more corporatized global companies still enjoy relatively easy access to funding from banks and institutional investors, while small to mid-sized companies in the diamond sector face more challenges in obtaining funding since bank requirements are constantly stepping up because of the enhanced regulations I referred to earlier. They require bank loans from a few million dollars to around $50 million.

Furthermore, we need to recognize the differences in the diamond sector itself. In some regions, banks and investors are more active than in others. This means that a shortage of financing may occur in some areas where it may not even be possible to open a bank account, or even some accounts may be frozen. When that happens, companies may not be able to pay salaries and/or rent. This all will lead to further consolidation and further corporatization. Is that bad? Not really, as I am convinced that some smaller companies will overcome these challenges and reinvent themselves into a healthy and sustainable business, thus becoming more bankable again. Under pressure, a lot is possible. I see a whole new generation of diamantaires rising up and taking responsibility to innovate in terms of strategy, technology, design, polishing, and all kind of new partnerships. Think of the Young Diamantaires Group with almost 300 active members from 18 different countries—the new generation that has shown creativity in problem solving and creating new opportunities for the diamond and jewelry industry. All of the above has created huge opportunities for new trading hubs, where the platforms are making more asset-based funding available to their clients. It is perhaps time for new initiatives, especially when financing is available, along with new technology, infrastructure, logistics, etc.

It is also important to mention that today banks and institutional investors look not only at their client’s balance sheet, ratios, and strategy, but also at their Corporate Social Responsibility (CSR) agenda. These investors want to know if their clients are taking matters such as environment, social responsibility, and governance seriously enough. Such organizations as the Responsible Jewellery Council (RJC) and the World Jewellery Confederation (CIBJO) are extremely active in those areas and can provide guidance for industry players to fulfill CSR and Environmental, Social and Governance (ESG) goals in line with the UN 17 Sustainable Development Goals (ESGs).

What Effect has the Pandemic had?

I don’t think there has been a significant or structural change in financing of the diamond industry because of the pandemic. Having said that, the decline in trade due to the pandemic reduced the need for diamantaires to seek financing, which in turn meant that banks have less debt outstanding on their books. The banks—as partners in business with the industry—are thus in a better position to help companies recover after the pandemic. And some financial institutions were more lenient in their terms to help clients get through these unprecedented times.

I am confident that the market will recover after this reset. People did not go out much during the lockdown. They did not spent a lot of money. When markets open up, I am sure they will want to treat themselves to art and jewelry. This is happening already in Asia. Self-purchasers and the younger generation will lead this trend, in my opinion. Bridal will be strong, too, since many weddings were postponed due to the virus.

Yet, one caveat though. I am convinced that people want to buy jewelry and art that has a story, a purpose, not just something from the shelf or the counter. Storytelling, provenance, authenticity, natural, and socially responsible—will be even more important.

LuxuryFintech - Technology in Service of the Luxury Jewelry and Art Sector

When I left ABN AMRO in 2018, I took a break and reflected on my banking career and I decided to bundle all my experiences in banking and corporate sustainability into a value proposition for companies in the luxury sector with a focus on art and jewelry. I added my new expertise in financial technology—fintech—particularly related to blockchain. Yes, blockchain is a buzz word, but it represents a very important new technology, as important as the internet itself.

I thus created LuxuryFintech, whose services are related to (re)structuring, funding, introductions, improvement programs, consolidations, etc. This new adventure is very exciting, and, despite the Covid lockdown and curfews, we are well-positioned to provide services for 21st century businesses. We are supporting many initiatives in various states. One of them is FineArtBourse - YourDiamonds, which is a trading/auction platform with full transparency of pricing in the diamond world. Another is Gemcloud, a unique B2B buying/selling platform for the colored gemstone industry. Others involve advising companies in the art sector as well as introductions of investors to gemstone companies seeking funding such as Greenland Ruby. Last but not least, we are involved in developing production facilities for lab-grown diamonds in Canada, B.C., in its very early stage.